- Products

Automate any process, anywhere Streamline complex, mission-critical workflows with the Agentic Process Automation System. Explore the Platform Explore the Platform

- AI System

- Build AI Agents

Automate advanced tasks with AI Agent Studio.

- Streamline workflows

Rapidly design and deploy with Automator AI.

- Process complex documents

Extract and organize data with Document Automation.

- Discover opportunities

Identify inefficiencies with Process Discovery.

- Orchestrate automations

Centralize initiatives with Automation Workspace.

- Build AI Agents

- Automation System

- Govern programs

Establish frameworks and oversight with CoE Manager.

- Automate from any app

Get AI-powered assistance with Automation Co-Pilot.

- Speed workflows with cloud

Power instant data exchange with serverless Automation Anywhere Cloud Service

- Unify systems

Connect applications and workflows with seamless integrations.

- Govern programs

- View all Products

-

- Solutions

Featured Solutions

Google Cloud Google Cloud and Automation Anywhere empower enterprises to fast-track their AI + Automation journey. Google Cloud

Google Cloud Google Cloud and Automation Anywhere empower enterprises to fast-track their AI + Automation journey. Google Cloud Amazon Web Services Streamline workflows, reduce costs, and make automating even easier when you combine the Agentic Process Automation System with AWS Amazon Web Services

Amazon Web Services Streamline workflows, reduce costs, and make automating even easier when you combine the Agentic Process Automation System with AWS Amazon Web Services- By Industry

- By Function

- By Technology

- View all AI Solutions

-

- Resources

Get Community Edition: Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.

Featured

Named a 2024 Gartner® Magic Quadrant™ Leader for Automation. Celebrating Six Years of Recognition as a Leader. Download report Download report

Named a 2024 Gartner® Magic Quadrant™ Leader for Automation. Celebrating Six Years of Recognition as a Leader. Download report Download report - Customers

New & improved certifications

Give yourself a competitive advantage with Automation Anywhere's industry-recognized certifications.Explore Certifications Explore Certifications

Give yourself a competitive advantage with Automation Anywhere's industry-recognized certifications.Explore Certifications Explore Certifications - Company

Get in touch with us Get help, know more, learn, ask questions, or just say Hi! Contact Us Contact Us

- Get To Know Us

- Announcements

- Society

-

Blog

From Manual to Marvel: Propelling Banking Compliance Management

Regulators are intensifying enforcement actions for non-compliance with banking regulations. This can mean stress and sleepless nights for banking leaders as they grapple with how to protect assets and customers while avoiding penalties.

Sound familiar? It’s a challenging task for a number of reasons:

- Processes are resource-intensive: Investigating AML, KYC, or fraud relies heavily on manual tasks like sourcing data, reviewing documents, and writing reports. This inefficiency leads to backlogs in researching alerts, which in turn increases financial and regulatory risks.

- Systems are fragmented: Many bank systems are not interconnected, resulting in multiple handovers and manually triggered tasks. In addition, banks have deployed point solutions for activities like identity verification but rely on manual work to integrate these tools into end-to-end workflows. Investigators sometimes need to do a lot of ‘swivel chair’ work to bridge the gap between systems by rekeying from one to another.

- Data collection involves multiple handoffs: Investigators must consult a range of internal sources (like account histories and customer service records), and external data (such as corporate registries, sanctions lists, and social media). This process is typically carried out in sequential order, which extends the time to complete investigations.

Agentic process automation can handle up to 80% of tasks

In the past, banks have implemented robotic process automation (RPA) to automate up to 40% of tasks. Now, there is a new opportunity to further transform processes: agentic process automation (APA) not only incorporates the ability to automate actions but also the ability to reason and learn using generative AI.

Whereas AI tools for personal productivity only work on simple tasks within a single application stack, APA spans an entire workflow, enabling users to automate up to 80% of tasks.

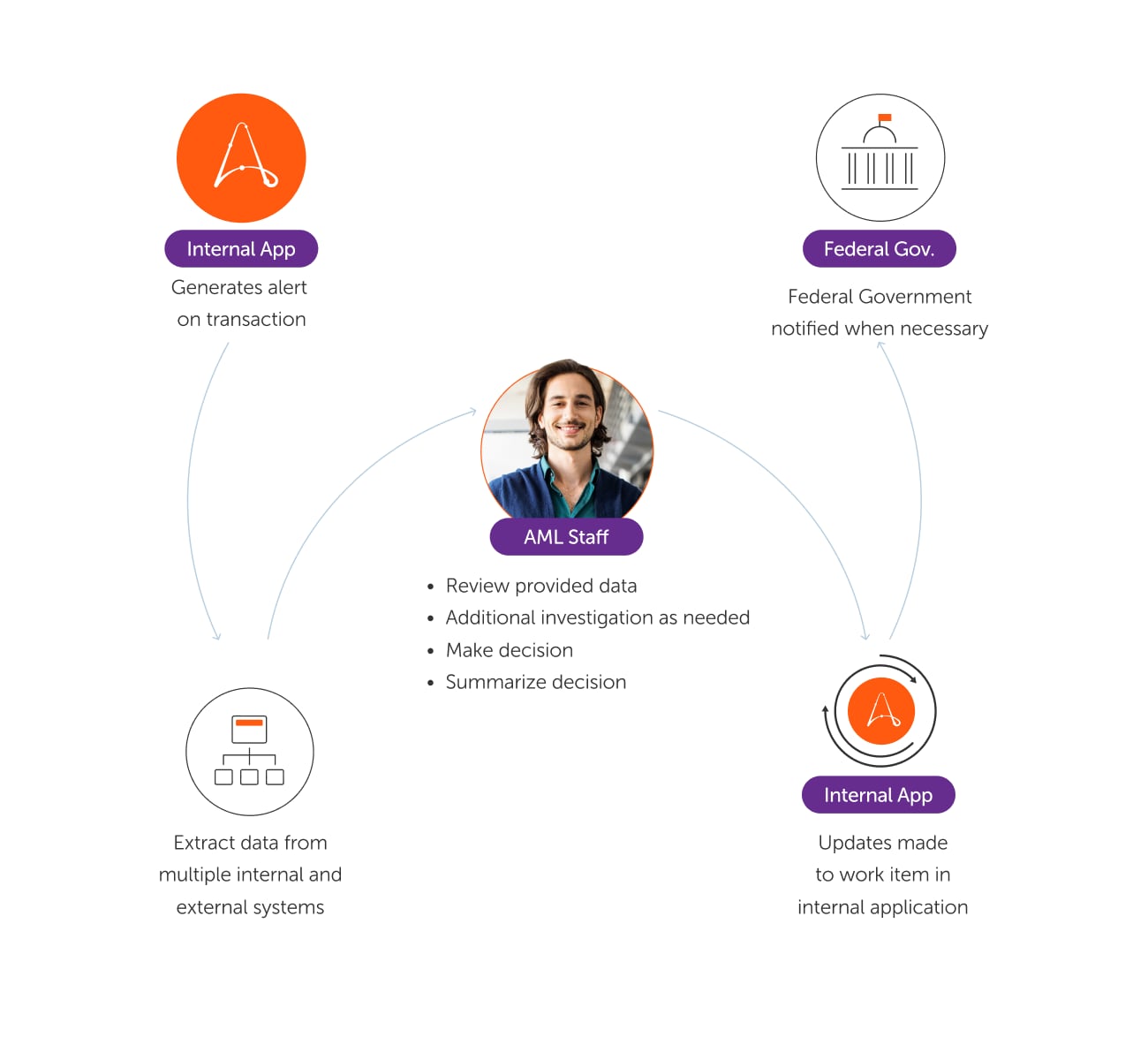

Anti-money-laundering reviews still rely on manual labor

For example, consider a typical AML case review, as shown in Figure 1. Many banks already use automation to extract data from internal and external systems, however most of the remaining process is still manual.

The investigator must:

- Painstakingly review large volumes of information

- Manually input data into internal applications

- Identify other entities that appear to be connected to the applicant

- Make a decision based on professional experience

- Create a narrative of the research and decision for internal documentation and regulatory review

- Create a suspicious activity report (SAR), if necessary

- Update internal compliance management systems

Figure 1: A typical AML workflow with limited automation.

Generative AI streamlines the AML review process

APA orchestrates bots and AI agents to automate most of this workflow, as shown in Figure 2. Based on the data sources collected automatically, generative AI extracts key data elements, identifies other entities that need to be investigated, and creates a narrative summary of all the gathered information.

Human investigators spend a lot of their time reviewing information about a case, but AI helps accelerate the review by creating a narrative summary of all the gathered information and highlighting the most important risk factors. An investigation recommendation AI agent reviews the collected information and provides a recommendation regarding actions to mitigate risk.

Figure 2: Agentic process automation (APA) automates the AML investigation end-to-end, with a human in the loop to review recommendations and make decisions.

A human in the loop then reviews the recommendation along with the narrative summary and supporting information, and makes the decision. The investigator’s role is transformed from one that is primarily administrative—collecting and processing data—into one where they can focus on the quality of decisions, using AI to assess the information more quickly.

The chasm between the old and new ways of managing compliance processes may, at first, seem pretty wide. But you can implement APA in stages, making progress, mitigating risk, and adding value at each stage. Before you know it, you’ll be passing heights of efficiency and risk management that you never thought possible.

Learn more about our solutions for financial services here.

About Ken Mertzel

Ken Mertzel is the Global Industry Leader for Financial Services and has extensive industry experience in translating financial data into strategic information to improve business performance.

Subscribe via Email View All Posts LinkedInGet to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.