Drive better loan decisions with agentic process automation

Lend with Confidence

AI agents validate application data and ensure compliance with policies and regulations, helping you approve loans faster and reduce risk by up to 70%.

Speed Up Approvals

AI agents orchestrate underwriting workflows across systems to deliver decisions in minutes, cutting processing times by 60% with accuracy and compliance.

Minimize Risk, Maximize Trust

Using AI-driven insights, AI agents identify and flag potential risks in real time, delivering consistent, accurate results that build customer trust and meet regulatory standards.

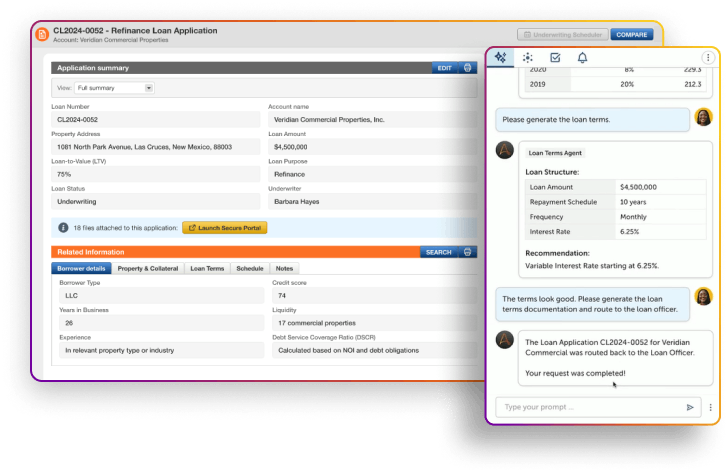

Agentic process automation for near-instant loan approvals

Customer Story

A Top US Retail Bank

Tesla loan approvals are a race. Traditional automation took hours, costing sales. Agentic process automation slashes processing time by 88%, with AI agents working alongside loan officers to handle verification, compliance, and approvals in minutes—driving faster closings, lower credit risk, and more deals won.

45%

increase in loan closing

20%

increase in underwriting margin

50%

reduction in credit risk

Prepare for AI agent success

Access expert resources to align teams, maximize AI agent potential, and drive measurable business impact with confidence.

Share key insights

Download a concise 2-pager to align your stakeholders with a clear overview of AI agents and their business impact.

Dive into the details

Explore the technical documentation to see how AI agents work and spark ideas for your own solutions.

Explore AI Agent Studio

Discover the tools you need to easily build, manage, and govern custom AI agents.

Empower every step of loan underwriting

Accelerate loan decisions with precise, compliant workflows powered by AI agents—streamlining everything from application review to risk assessment for measurable results.

Start delivering faster, smarter loan approvals with AI agents

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.