In recent years, the finance and accounting sector has seen a significant increase in intelligent automation to support their digital acceleration.

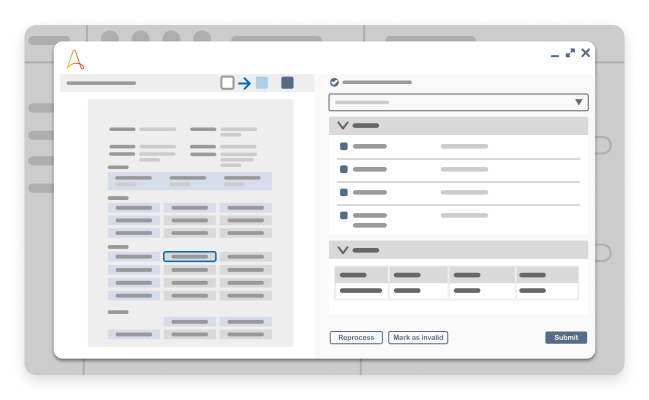

Intelligent Document Processing (IDP) is an RPA technology that captures data on business documents, increasing efficiency and turnaround time for accounts payable, accounts receivable, and treasury operations.

RPA incorporated with machine learning, and natural language processing can be used to capture data in structured and unstructured formats to optimize your entire Accounts Receivable process.

For example, organizations can use RPA and AI to process invoices instead of accounting personnel. Finance departments can manage invoice distribution requirements, compare pricing and company information, and review documentation. OCR data capture removes the need for manual data entry while removing human error.

What are the benefits of Intelligent Document Processing in accounts receivable?

Intelligent Document Processing is prevalent in finance departments because of the ability to turn unstructured and semi-structured information into searchable data with OCR. While that may sound simple, IDP uses cutting-edge technologies like natural language processing (NLP), Computer Vision, and machine learning (ML) to make our lives easier.

Improve Operational Efficiency

It often takes days to process a single invoice. Unfortunately, most of that time is spent in inefficient manual AR processes like filing, copying, mailing, retrieving, and faxing documentation. IDP provides the ability to file and retrieve structured and unstructured data, enabling users to use their document management system better.

Fast, Accurate Order Entry

AR departments receive orders in many formats, including fax, phone, email, EDI, online purchases, even remittances. Integrating Accounts Receivable IDP with ERP systems like SAP or Oracle allows accurate invoice processing, including data extraction, indexing, source monitoring, and easy document tracking.

Reduce Days Sales Outstanding

Outstanding AR payments are a recurring issue in B2B. Manual processing adds delays and errors, leaving portions of monthly revenue unavailable. RPA gives you accurate data to keep track of DSO, automatically send invoices at set times, automate reminders and collections, and provide digital payment options for more manageable payments.

Streamline Invoice Creation

Creating invoices and sending payment requests can be time-consuming and costly due to errors and delays. IDP and RPA makes onboarding new customers and invoicing easy. Invoices can be batch-created with templates based on company data, automatically delivered on set dates, and payments reconciled with accounting systems.

Enhanced Data Accuracy

Improperly executed invoice errors can lead to the loss of revenue and other adverse effects. Automation eliminates most, if not all, manual mistakes associated with data entry. Intelligent automation also manages accounts receivable, preventing revenue shortfalls and bad debts.

Stronger Internal Control

Managers of finance departments must trust their data to assess where bottlenecks and inefficiencies exist and how productive individual teams are. Adding IDP into the reporting workflow makes accurate metric collection easier. Software bots route-target information to the managers and automatically alert stakeholders based on set rules.

Reduce your days sales outstanding with IDP and RPA.

Take the bottlenecks out of your cash flow for a healthier bottom line.

Request demoWho benefits from accounts receivable with Intelligent Document Processing?

IDP has found its way into almost every business function and department in almost every industry. For example, Banking uses IDP to process mobile checks, and Manufacturing uses IDP to process incoming invoices.

Legal

AR automation with IDP supports Legal in multiple ways. For example, IDP can satisfy compliance reporting obligations by automatically producing accurate reports and real-time notifications to ensure legal requirements are consistently met.

Customer Service

Providing accurate invoices, consistent invoice delivery, ease of payment, and schedule gives agents instant access to customer data, providing them with an accurate, single source of truth on invoice and payment status.

Analytics Department

RPA provides a data-rich approach to AR that directly impacts analytics. Software bots create audit trails for improved visibility and update the central master data source in real-time. Accurate insights help identify potential non-payment risks and where to prioritize collections.

Sales Representatives

Using RPA technology like digital workers, sales reps can access more customer information, including credit limits, payment histories, and current activities. This helps them to make better sales forecasts and identify potentially risky customers.

TreasuryONE automates to deliver premier treasury services.

Customer Story

For us, the big thing is to have the bots do the heavy lifting. Not to replace our people, but to let the bots do the stuff that bots are good at, and let our people focus where they excel: building relationships and providing better service to our clients.

100%

Reduction in errors

4

End-to-end, critical business processes automated

70

Weekly hours refocused on Customer Satisfaction

How accounts receivable with Intelligent Document Processing can help your accounting department?

IDP is helping move digital transformation adoption forward. In addition, compliance with paperless regulatory initiatives further pushes for business process automation. But how does AR Automation and IDP help your organization’s bottom line?

Here are a few examples of how automation can help your business survive and thrive:

Get Paid Faster

- Extract payment data from various sources, including unstructured print and semi-structured digital.

- Instantly create invoices on demand based on entered details.

- Keep invoices moving through approval processes with automated notifications to next-in-line stakeholders.

- Quickly and accurately communicate with customers about the status of their invoices.

- Automatically distribute invoices to client specified locations, whether email or a client’s legacy platform.

- Offer easy payment methods, connect to payment institutions and notify stakeholders when payments are made.

Optimize AR Processes

- Digitize credit applications, removing the need to scan in paper documents.

- Provide new customers online access to fill out credit applications, reducing potential scheduling conflicts.

- Pull pertinent customer data from multiple sources, removing the need to search through information manually.

- Automatically monitor payment status and send friendly follow-ups to encourage payment of outstanding invoices.

- Integrate with ERP systems, accounting software, and invoicing platforms for automated delivery.

- Remove invoicing delays due to inaccuracies or approval holdups.

Win Back Agent Time

- Remove constant, tedious work that can lead to errors, missed hand-offs, and omissions.

- Free employees to find other ways to streamline financial processes and accounting tasks.

- Reduce invoice processing times, allowing employees to process more invoices faster.

- Automatically track all of your AR-based activities and keep accurate records for legal requirements.

- Automate entry records into ledgers.

- Log on/off to multiple legacy platforms with one sign-on to save time at the beginning and end of the day.

Operational Continuity

- Instantly connect RPA to any system with zero development work.

- Mitigate risk and ensure data security with role-based access and audit trails.

- Scale implementation at your pace, whether you automate each process or are considering hyperautomation.

- Make employees more adaptable with Digital Workforce support.

- Accelerate disaster recovery with the ability RPA provides to make business infrastructures more flexible.

- Keep the company going during data center disruptions by instantly providing distributed data access.

What to look for in IDP solutions for accounts receivable?

There are many AR automation solutions, but not all are the same. So what should you look for?

Is the solution flexible? Your chosen RPA solution should be able to work on-premises, on hybrid ecosystems, or on the cloud. It also needs to reach all of your locations for a complete corporate view of data and supply.

Does it allow for invoices to be sent in a variety of ways? For example, some customers prefer paper invoices, while others prefer digital distribution. Your AR automation solution should be flexible enough to handle invoice distribution.

Is your RPA software capable of integrating with third-party and legacy apps? AR automation should quickly and easily integrate with your ERP and other existing technologies.

Finally, is it secure? When handling monetary transactions, your data must be protected. Ensure your chosen RPA platform provides the data encryption and the role-based access you need to keep your data safe.

How to get started?

You can request a demo, and be guided through our platform by automation experts to help you develop a Proof of Concept.

Finally, sign up to Automation Anywhere University for role-based training paths. Get hands-on experience with no-code, drag-and-drop bot creation and learn how easy it is to use in accounting.

Request demoMore resources about Intelligent Document Processing for accounts receivable.

Get to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.