RPA (Robotic Process Automation) is best described as a business process tool to automate manual, intensive, repetitive, and rule-based tasks. This technology has already made considerable strides in banking systems, helping employees deal with colossal volumes of customer data in their workflow, improving the customer experience through real-time engagement, and providing substantial savings of time and money.

Since trade finance remains focused on paperwork and error-prone, time-consuming processes, RPA is an ideal solution. Leveraging the power of automation and artificial intelligence against business processes can streamline your trade finance operations, keeping you competitive and profitable in an industry of thin margins.

What are the advantages of trade finance process automation?

Large amounts of unstructured data, mainly paper-based and suffering from information fragmentation, are a trade finance hallmark. Digitizing your paper documents with OCR (Optical Character Recognition) and performing data extraction to facilitate modernization is just scratching the surface of the capabilities and potential of RPA in the trade finance ecosystem. Other benefits that trade finance might see from a digital transformation include:

Transaction Speed

RPA bots are capable of trade finance processing, increasing the number of concurrent transactions, allowing your operations to expand utilizing a smaller workforce, or augmenting your current workforce to increase their productivity. This can give you many benefits through processing while maintaining oversight of the transactions.

Documentation and Tracking

Software bots can help you get a handle on your unstructured data and track information with a high degree of accuracy. They can pull data from any document necessary–trade documents, application forms, letters of credit–virtually unlimited sources. Then, track every aspect of your trades with granular process visibility and real-time alerts.

Reduced Fraud

AML (anti-money laundering) is the next wave of process automation in the finance industry, leveraging semantic analysis and artificial intelligence to pinpoint instances of trade finance crime. RPA security backed by AI is crucial in identifying and stopping international fraud and money laundering.

Savings of Time and Money

The streamlining trade finance operations offer transactions with fewer errors, savings on the finding, hiring, and training of employees, and the reduction of fraud all work together to produce dramatic savings for both human time and hard capital.

Protect Margins

Keep your value chain connected and healthy. Use real-time updates to keep everyone, from marketing and sales to logistics, operations, and service, on the same page, moving toward the same goal, with the same understanding. Convert your savings of time and capital to profit and give yourself a cushion on thin margins.

Solution Flexibility

Capable of seamlessly integrating with API-based modern systems or legacy systems, intelligent automation can provide solutions that are attended or unattended bots, with RPA working side by side with humans. Our solutions tend to be cloud-based for ease of deployment but can be deployed onsite if necessary.

Simplify your trade finance operations.

Learn how RPA can help you scale your operations while focusing on strategic decisions.

Request demoWho can benefit from trade finance process automation?

Virtually every part of your trade finance business processes can benefit from RPA, from the contact center to the back office and your core banking systems. The flexibility of Robotic Process Automation makes it ideal for:

Trade Credit Underwriters

Streamline payment processes and reduce turnaround time on trade finance transactions by augmenting human efforts with aggregation, organization, and validation of large volumes of data, reducing human error rates and the need for oversight.

Banks and Trade Finance Companies

Bots can be built to capture and process all necessary documentation, alert for missing documentation, reduce human processes that are error-prone, calculate loan payouts, make compliance checks, assess risks and perform decision-making based on qualifications.

Importers/ Exporters

RPA can reduce logistical risks by helping determine the best way to spread orders over multiple suppliers in your supply chain, mitigate regulatory risk by helping make sure that operations match the regulatory standards of the countries you operate in.

Export Credit Agencies and Service Providers

Use intelligent OCR to digitize and turn unstructured documents into readily available data sources. By applying artificial intelligence (AI) or machine learning (ML) along with natural language processing (NLP) rules, credit agencies can carry out documentary checks in a timely fashion.

Signify accelerates innovation and drives first-time-right using RPA

Customer Story

Automation and Robotization are fundamentally changing service delivery in finance for the better.

60%

Reduction in AHT

50%

FTE’s freed up for innovative work

100%

Transparency into financial operations

How can trade finance process automation help the finance industry?

The potential provided by robotic automation is virtually limitless in the possible applications when examining trade finance for business processes that could be partially or entirely automated.

Logistics

- Track shipments and payments

- Get real-time alerts on transactions status

- Find the best suppliers and shippers based on changing information

- Ensure international trade regulation compliance

Operations

- Extract and evaluate large amounts of data from disparate sources

- Integrate paper, legacy, and API systems seamlessly

- Make fewer costly mistakes

- Automate finance credit decisions

Marketing and Sales

- Automate portions of customer outreach and retention

- Evaluate marketing decisions for most effective results

- Generate accurate time reports from sales and marketing data

- Calculate sales predictions

Service

- Customer tools for account management

- Digitize customer paperwork

- Provide customer training

- Automate the answering of customer inquiries

What should you look for in a trade finance process automation platform?

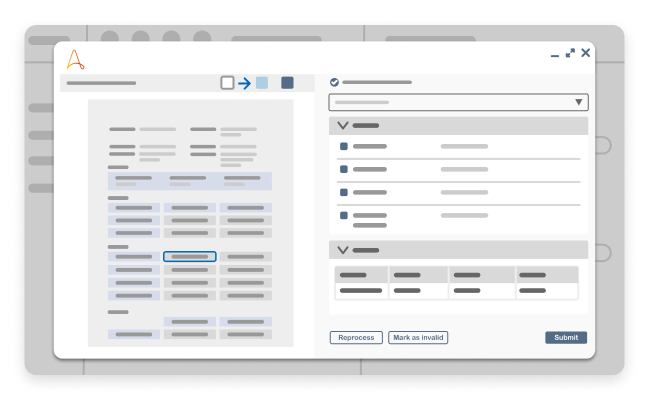

Trade finance process automation isn't a new field by any means, but it is a rapidly changing industry with a high level of repetitive aggregate, extract, and compare work with error-prone manual processes that can be handed off to automated bots. Therefore, for the highest level of flexibility, your trade finance solution RPA provider should furnish a robust RPA architecture that can seamlessly interface with legacy systems and more modern, API-based systems.

Optimally, your RPA provider should offer products backed by other technologies like AI and ML (machine learning) to provide a robust solution. At the least, the best solution should offer:

- End-to-end process automation/ augmentation

- Detailed reports

- Automated alerts

- Real-time tracking

Because every organization differs, even in seemingly insignificant ways, other capabilities and benefits can only be realized by implementing the system within your unique company.

How to get started with trade finance process automation?

Get started with trade finance process automation by contacting one of our automation experts versed in RPA, and they can provide a demo of our automation software.

Request demoMore resources for automation in the finance sector.

Get to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.