Accounts payable is an essential function of any company. However, data entry, invoice processing, generating purchase orders, paper invoices or e-invoicing, monitoring cash flows, and other workflows are often manual processes that lead to errors, disputes, and delays in procurement or payments.

Most accounts payable automation software can accelerate document management, reduce errors, streamline workflows and create efficiencies. For example, AP automation solutions use optical character recognition (OCR) to extract invoice data, assisting the payable process.

Automation Anywhere offers Cloud Robotic Process Automation (RPA) with artificial intelligence (AI) for rapid end-to-end AP automation.

What are the benefits of accounts payable automation?

Accounts payable software can streamline workflows, digitize the AP process, assist in data capture, generate purchase orders, automate accounts, eliminate backlogs with payment automation, reduce manual processes and improve document management and data capture.This can improve cash flow, increase audit trail accuracy, reduce human errors, and provide greater compliance and security.

Improved Invoice Management

AP automation can improve the payment process by generating automated invoices, which are automatically reconciled against contracts, goods received, and purchase orders. Electronic validation of invoices against these data sources reduces human error and increases cash flow.

Better Analytics and Insights

By automating accounts payable, you can have better transparency and insight into cash flow. In addition, you can easily import and export data for up-to-date financial reporting, improve spending visibility for budgeting and forecasting, and improve business cycle planning.

Vendor Management

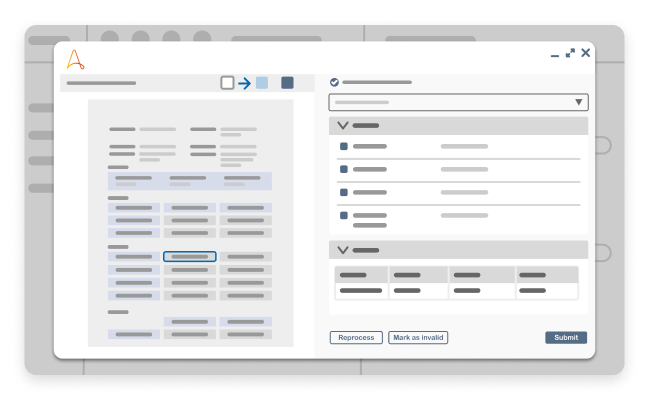

Intelligent automation creates new vendor profiles using Automation Anywhere’s Document Automation. It can process invoices and route them to the AP team for validation, enter them in the enterprise resource planning (ERP) system, match invoices to the purchase order and goods receipt, monitor invoice approval, and process payments.

Fraud Detection

Intelligent automation using OCR/AI authenticates documentation, detects payment anomalies, cross-reference invoices to supplies to verify goods or services have been received prior to payment, and flags discrepancies for investigation by the AP team in real-time, on multiple accounts simultaneously.

Increased Efficiency

RPA payment automation replaces manual tasks, reduces human error, updates the accounting system with invoice automation, pulls data, creates purchase orders, updates dashboards payment methods, and generates reports. This reduces processing costs, allows AP staff to concentrate on higher-value tasks, and reduces overall costs.

Transparent Audit Trails

RPA invoice management can cross-check multiple data sources, flag duplicates or discrepancies, and generate statements and exceptions. It simultaneously authenticates information for compliance and accounting standards in numerous jurisdictions, ensuring adherence, reducing risk, and providing more security with real-time audit trails.

Discover how automation can help you handle your ap pain points.

Our blend of automation and human workflow helps global businesses work faster and more accurately, for improved cash flow and stability.

Request demoWho benefits from accounts payable automation?

While the AP team is the logical beneficiary of accounts payable automation, there are benefits across the organization. AP automation solutions have a positive ripple effect across the organization. Here are some of the benefits:

Procurement

AP automated solutions help procurement with real-time inventory updates, improved accuracy, end-to-end invoice management, and report generation. For example, procurement requests can trigger an automatic purchase order, payments are reconciled, and ledgers and accounts are updated.

Sales

RPA creates comprehensive customer profiles from multiple sources, providing sales with cross-selling opportunities. In addition, delinquent or fraudulent accounts can be flagged for investigation immediately upon detection, providing secure due diligence and fiduciary oversight.

Finance

RPA and AP automation can provide accurate cash flow information by aggregating and consolidating real-time data for budgeting and forecasting. In addition, it can analyze variances, prepare management reports and comply with accounting and compliance protocols in multiple jurisdictions simultaneously.

Customer Relationship Management

AP automation generates purchase orders or invoices, captures emailed or faxed invoices, tracks approvals, extracts data, reconciles amounts to PO or shipment delivery receipts, authorizes payments, notifies providers, and updates dashboards. Staff focus on relationships, not data entry.

Stant automates complex accounts payable processes

Customer Story

RPA has begun to show benefits towards our corporate objectives. Thanks to Thirdware and Automation Anywhere, we have been able to improve performance, increase efficiency and reduce our invoice backlog simultaneously. Our success with RPA to date has given us the confidence to move forward and automate even more processes.

80%

invoice straight-through processing

0

data entry errors

94%

targeted supplier invoices processed

How accounts payable automation can help your business?

Manual AP processes are time-consuming and subject to manual errors. If resources aren’t entered into the ERP system accurately, it can have a ripple effect on the supply chain, inventory, purchasing, and financial teams’ forecasting.

An accounts payable automation solution can digitize manual functions, allowing the organization to go paperless, with searchable and accessible comprehensive data.

Automated Invoicing

- Pay invoices when verified—no more missed early payment discounts due to late payment.

- Pull data from purchase orders shipping manifests and sends as soon as orders are received.

- Stanley Black & Decker saved $3.3 million and automated over 1500 journal entries by incorporating RPA.

- Extract invoice data, reconcile amounts to PO and shipment delivery receipts and authorize payments.

- Digitize the invoice process, create paperless records that are accessible anywhere, and reduce storage space.

Financial Operations

- Automate the monthly general ledger close process and generate real-time financial reports from the ERP system.

- Automate sourcing aggregating data, so finance teams focus on financial analysis and strategic planning.

- Reconcile consolidated bank account balances with cash reported on the balance sheet for real-time cash flow.

- Reduce inaccurate or duplicate invoice payments time-consuming manual data entry error reconciliation.

- Comply with multi-jurisdictional compliance and accounting protocols simultaneously.

- Auto-generate delinquency reports, statements, account reconciliations, and exception reports.

Audit and Compliance

- Real-time accurate financial forecasting, reporting, and procurement reports.

- Document authentication and verification flags anomalies and discrepancies to detect fraud early.

- Access customer data to improve KYC analysis, automate transaction monitoring, and track regulatory changes.

- Document Automation monitors AML (Anti-Money Laundering) regulations, client risk profiles, and account monitoring.

- Navigate legacy systems and connect front-office and back-office operations for comprehensive reporting.

- Checks and balances to analyze structures, assess threats, and address potential security weaknesses.

Customer Onboarding

- Automate new account setup activities and streamline data collection from internal and external systems.

- Access or aggregate data across multiple systems, handle change requests, and create comprehensive client profiles.

- Collect data from applications, legacy systems, browsers, databases, and email to create client profiles.

- Extract and index documents, order third-party reports for credit checks and document authentication.

- Scale your AP automation solution as you scale your business.

- Digitizing manual processes allows employees to focus on relationship management.

What to look for in an accounts payable solution?

When you are automating your AP department, there are several factors to consider. Accurate data aids in forecasting budgets, controlling corporate spending, reducing fraud, and analyzing cash flow to help businesses better manage their working capital. On the other hand, inaccurate information can adversely impact businesses by resulting in unnecessary late fees, vendor supply issues, and credit problems.

You need a provider who can capture data from various systems, including legacy systems, accurately capture invoice data, manage the invoice approval process, and track AP invoices through the system. The AP automation must be scalable while offering integration to your accounting system. The solution needs to automate various payments, including electronic bank transfers and checks.

Can your provider scale with your business, have robust compliance and accounting protocols, including AML and KYC, and be customized to multi-jurisdictional requirements? How are updates handled, and who is responsible? What kind of after-sales support and training is provided?

How to get started with accounts payable solution?

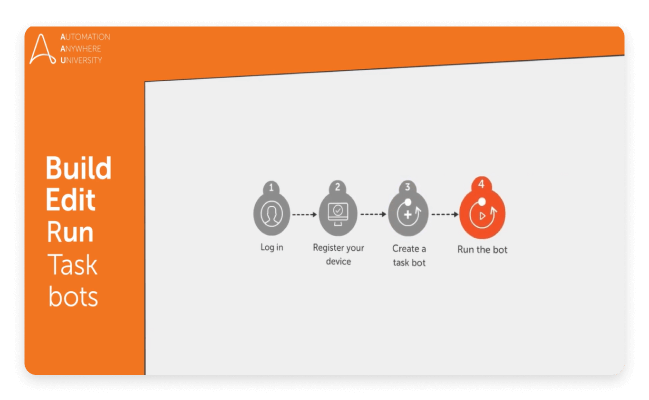

We offer a comprehensive training platform at Automation Anywhere University to assist your staff to grow their capabilities to create custom, AP automated systems to meet your organizational needs.

Request demoMore accounts payable automation resources.

Get to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.