Loan approvals in seconds? Yes, it’s a thing.

Power precise, compliant loan processing workflows with AI agents.

See how

Where can banks use agentic automation? Everywhere.

Trusted, rapid, and ready for anything. Put agentic automation to work across banking operations.

With its speed and flexibility, agentic automation gives financial services the means to better handle risk, boost compliance, and say goodbye to errors. It lets your workforce zero in on work that matters—like connecting with customers and designing fresh financial products.

KeyBank redefines productivity with agentic automation.

Responding to rapid change with no time to hire new staff, KeyBank utilized AI-enabled data extraction and easily completed nine years of work in 14 days.

40,000

Documents processed

9 Years

of work done in two weeks

$5M

Run rate savings in 2020

Save time. Simplify compliance. Safeguard your data.

Financial institutions are juggling the twin challenges of regulatory complexity and cybersecurity threats. The solution? Agentic automation. It not only fast-tracks resource and data-intensive workflows, it shields your organization from operational risk and fraud by strengthening security, compliance, and controls.

A lifesaver for banks drowning in siloed data and processes.

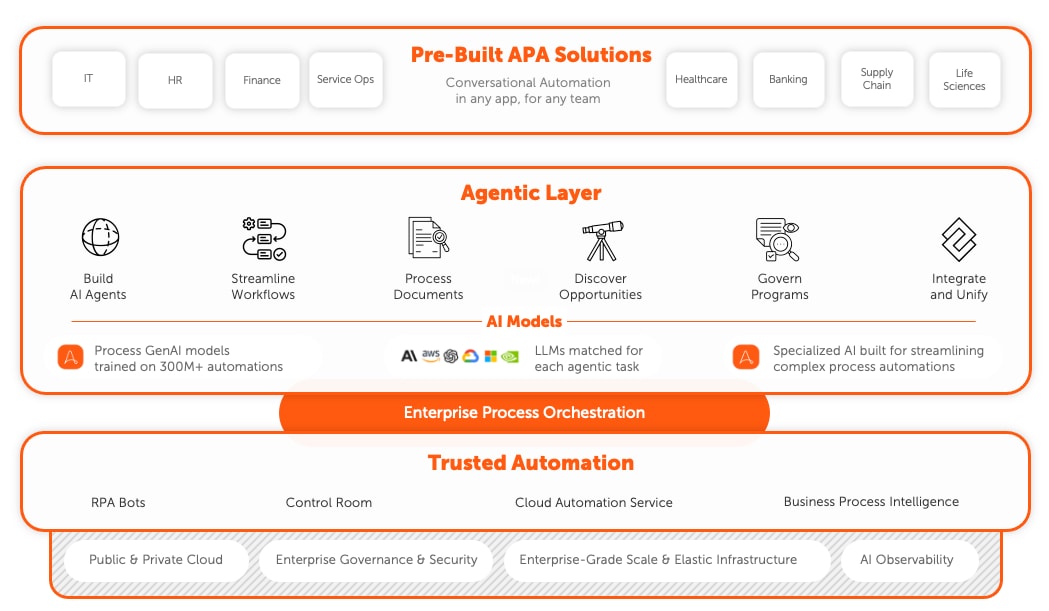

The Agentic Process Automation System unites all enterprise apps and data, while preserving privacy, security, and controls. Dream come true? We think so, too. Agentic automation makes it easy to streamline critical banking and compliance processes to mitigate risk, reduce fraud, and drive efficiency in a sea of change.

Save money. Get more work done. Strengthen security and controls.

Improve compliance

Agentic automation delivers systematic and consistent monitoring and reporting.

Reduce fraud

Monitor transactions to flag suspicious activity and respond quickly to potential fraud.

Increase productivity

Streamline and automate processes to get more done and free resources from repetitive tasks.

Cut errors and operational losses

Get more done, more efficiently, while eliminating errors and data silos by connecting legacy systems.

Fuel growth

Free up teams to focus on new business with agentic automation right within the apps they use.

Lower costs

Simplify and automate manual processes, eliminate processing errors, and reduce risk.

Any team, any banking process—and everything in between.

Automate complexity with agentic AI + automation and see efficiency, compliance, and productivity soar across teams and processes.

- Consumer & commercial banking

- Risk and compliance

- Lending

- Customer service

From lending and customer experience to cards and payments, agentic automation delivers efficiency and speed. Automate:

- Account opening/close

- Address and account changes

- Loan origination, status, and payment inquiries

- Underwriting and fraud detection

- Payment processing

- Complaint resolution

- Pre- and post-call support

Move to continuous risk management with the Agentic Process Automation System to extract data, monitor transactions, and speed processes. Apply agentic automation to:

- KYC compliance

- AML monitoring

- Risk identification

- Financial crimes sanctions

- Regulatory reporting

- Compliance/data testing

- Ongoing monitoring and audits

Automate every facet of the lending process with the help of AI agents, from loan origination to status updates and payment inquiries. Improve underwriting, risk assessment, fraud detection, loan documentation, collateral management, regulatory compliance, and loan servicing. Plus, resolve complaints fast with smart pre- and post-call support.

Make customers happy with personalized, fast service. Apply AI agents to automate customer onboarding, investigate fraud, and resolve transaction disputes. Handle customer complaints quickly and in accordance with regulatory requirements. Support customers with payment processing. Identify banking products to offer based on customer needs and profiles.

Hear from customers how the impact of agentic automation adds up.

Customer Quote

Automation Anywhere is customer-centric, highly innovative, and a trendsetter in intelligent processing.

Customer Quote

Agentic automation allows our operations to scale with the fluctuating market while retaining our valuable employee base.

Automate complex banking processes. Outperform your competitors.

See how the Agentic Process Automation System increases the security, compliance, and efficiency of even the most complex banking and financial services processes.

Get a demoWhat customers have to say about us.

Find out why our customers keep coming back.

What real users are saying about Automation Anywhere vs. UiPath.

I’ve used UiPath as a developer. Now, I’m using Automation Anywhere as well. When I compare both, the biggest point is cognitive abilities. The Document Automation is the best in class. You won’t find that even in UiPath.

What real users are saying about Automation Anywhere vs. Microsoft Power Automate.

We also explored Microsoft’s Power Automate. However, it wasn’t as mature or up to an enterprise level at the time. Automation Anywhere had good standards and excellent support, in terms of architecture, design, and user interface, we chose Automation Anywhere. It also has good community support.

What real users are saying about Automation Anywhere vs. Blue Prism.

We had to switch to Automation Anywhere due to the high initial license fee associated with Blue Prism. Automation Anywhere is more cost-effective.

What real users are saying about Automation Anywhere vs. alternative solutions.

Before using Automation Anywhere I checked Blue Prism & Ui Path but I preferred Automation Anywhere because it is best in quality. It also has Document Automation for unstructured data converting in structure.

Tap into a wealth of resources on agentic automation in financial services.

Start here: Top 5 areas to automate in finance

Learn how AI agents automate complexity while maintaining top-tier security and compliance.

Get the ebook

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.